Financial analysis with Microsoft Excel 9th Edition empowers professionals with an indispensable tool for making informed business decisions. This comprehensive guide unlocks the secrets of Excel’s advanced features, enabling users to navigate complex financial data with ease and uncover actionable insights.

Throughout this in-depth exploration, we will delve into the fundamentals of financial analysis, master data preparation and management techniques, and explore advanced applications of Excel in financial modeling and decision-making. Get ready to transform your financial acumen and elevate your business performance.

1. Introduction to Financial Analysis with Microsoft Excel 9th Edition

Definition of Financial Analysis and Its Importance

Financial analysis involves evaluating financial data to assess a company’s financial performance, health, and prospects. It is crucial for making informed business decisions, such as investment decisions, credit analysis, and budgeting.

Role of Microsoft Excel in Financial Analysis

Microsoft Excel is a powerful tool for financial analysis due to its ability to organize, manipulate, and analyze large datasets. It provides a wide range of functions, formulas, and charting capabilities specifically designed for financial modeling.

Key Features of Excel 9th Edition for Financial Analysis, Financial analysis with microsoft excel 9th edition

- Enhanced data analysis tools, such as pivot tables and Power BI integration

- Improved charting capabilities for data visualization

- Advanced forecasting and modeling functions

- Integration with other Microsoft Office applications for seamless data exchange

2. Data Preparation and Management

Importing and Organizing Financial Data

To prepare data for analysis, it is essential to import it into Excel from various sources, such as accounting systems or financial statements. Excel provides tools for organizing data into worksheets and tables, ensuring data integrity and ease of manipulation.

Data Cleaning and Validation

Cleaning data involves removing errors, inconsistencies, and duplicates. Excel offers functions and tools for data validation, such as data validation rules and conditional formatting, to ensure data accuracy and reliability.

Managing Large and Complex Datasets

When working with large datasets, Excel provides features like data tables, pivot tables, and slicers to organize and summarize data efficiently. These tools allow for quick and effective analysis of complex financial information.

3. Financial Statements Analysis

Types of Financial Statements

Financial analysis typically involves examining three main financial statements: balance sheets, income statements, and cash flow statements. These statements provide insights into a company’s financial position, profitability, and cash flow.

Key Financial Ratios and Metrics

Financial ratios are used to analyze a company’s performance and compare it to industry benchmarks or competitors. Common ratios include liquidity ratios, profitability ratios, and solvency ratios, which provide valuable insights into a company’s financial health.

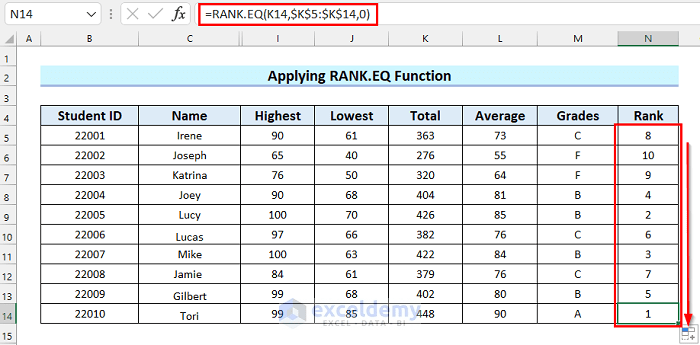

Using Excel for Financial Ratio Calculations

Excel provides built-in functions and formulas for calculating financial ratios. By utilizing these functions, analysts can quickly and accurately calculate ratios, allowing for efficient and comprehensive financial analysis.

FAQ Insights: Financial Analysis With Microsoft Excel 9th Edition

What are the key benefits of using Excel for financial analysis?

Excel offers a comprehensive suite of tools for data organization, manipulation, and visualization, making it an ideal platform for financial analysis. Its intuitive interface and powerful formulas enable users to quickly and accurately analyze large datasets, identify trends, and generate insightful reports.

How can I ensure the accuracy of my financial data in Excel?

Data accuracy is crucial in financial analysis. Excel provides robust data validation tools to check for errors, inconsistencies, and outliers. By implementing data validation rules, you can minimize the risk of incorrect data and maintain the integrity of your analysis.

What are the most important financial ratios to calculate in Excel?

Key financial ratios provide valuable insights into a company’s financial performance. Some of the most important ratios to calculate in Excel include liquidity ratios (e.g., current ratio, quick ratio), profitability ratios (e.g., gross profit margin, net profit margin), and solvency ratios (e.g.,

debt-to-equity ratio, times interest earned ratio).