Embark on an enlightening journey with the iCivics Government and the Economy Answer Key, your trusted guide to unraveling the intricacies of economic principles and government policies. Prepare to delve into a world of fiscal and monetary strategies, market dynamics, and the crucial role of government in shaping economic outcomes.

Our comprehensive exploration will illuminate the impact of government spending and tax policies on economic growth, income distribution, and innovation. We will dissect the central bank’s influence on monetary policy and its profound effects on employment, inflation, and economic stability.

Impact of Government Policies on Economic Growth: Icivics Government And The Economy Answer Key

Government policies can significantly influence economic growth by shaping the incentives and constraints faced by businesses and consumers. These policies include government spending, tax policies, and regulations.

Government Spending

Government spending can stimulate economic growth by increasing aggregate demand. When the government purchases goods and services, it injects money into the economy, which can lead to increased production and employment. However, excessive government spending can also lead to inflation and budget deficits.

Tax Policies

Tax policies can affect business investment and consumer spending. Lower taxes on businesses can encourage investment and innovation, while higher taxes on consumers can reduce spending and economic activity.

Government Regulations

Government regulations can have both positive and negative effects on economic growth. On the one hand, regulations can protect consumers and promote fair competition. On the other hand, excessive regulations can stifle innovation and hinder economic efficiency.

Government’s Role in Income Distribution

Governments play a significant role in income distribution through various mechanisms, such as progressive taxation and social welfare programs.

Progressive Taxation

Progressive taxation involves taxing individuals with higher incomes at a higher rate than those with lower incomes. This can help reduce income inequality by redistributing wealth from the wealthy to the poor.

Social Welfare Programs

Social welfare programs, such as unemployment benefits, food stamps, and housing assistance, provide financial support to low-income individuals and families. These programs can help reduce poverty and improve living standards.

Trade-offs

While income redistribution policies can reduce inequality, they can also have negative effects on economic growth. High taxes on the wealthy can discourage investment and innovation, which can slow down economic growth.

Central Bank’s Influence on the Economy

Central banks are responsible for managing monetary policy, which involves controlling the supply of money in the economy. Monetary policy can significantly influence economic growth, employment, and price stability.

Interest Rates

Central banks can influence interest rates by buying and selling government bonds. Lower interest rates can stimulate economic growth by encouraging borrowing and investment. However, excessively low interest rates can also lead to inflation.

Inflation

Central banks can also influence inflation by controlling the money supply. By increasing or decreasing the money supply, central banks can affect the overall price level in the economy.

Impact on Economic Growth

Monetary policy can impact economic growth by affecting the cost of borrowing and the availability of credit. Lower interest rates can stimulate economic growth by making it easier for businesses and consumers to borrow money and invest.

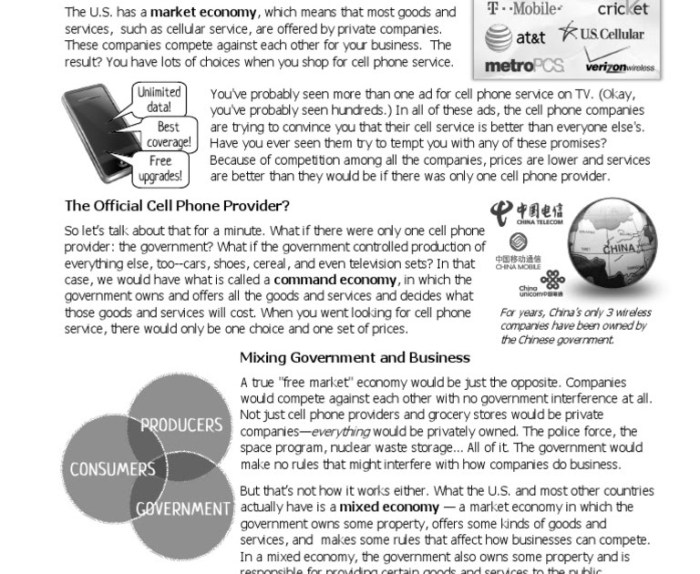

Government’s Role in Promoting Competition

Competition is essential for a healthy economy, as it promotes innovation, efficiency, and consumer welfare. Governments can play a role in promoting competition through antitrust laws and regulation.

Antitrust Laws

Antitrust laws prohibit businesses from engaging in anti-competitive practices, such as price fixing and collusion. These laws help ensure that markets remain competitive and that consumers have access to a variety of products and services at fair prices.

Regulation, Icivics government and the economy answer key

Regulation can also be used to promote competition. For example, governments can regulate industries to prevent monopolies from forming and to ensure that new businesses can enter the market.

Impact on Consumer Welfare

Competition benefits consumers by providing them with a wider range of choices, lower prices, and higher quality products and services.

Government’s Role in Providing Public Goods

Public goods are goods or services that are non-rivalrous (consumption by one person does not reduce the availability for others) and non-excludable (it is difficult or impossible to prevent people from consuming the good or service).

Direct Provision

Governments can provide public goods directly, such as by building roads, parks, and schools. This ensures that everyone has access to these essential services, regardless of their ability to pay.

Subsidies

Governments can also provide public goods through subsidies to private companies. For example, governments may subsidize the production of renewable energy or the development of new technologies.

Challenges

Providing public goods can be challenging, as it requires governments to balance the need for these goods with the costs of providing them.

FAQ

What is the role of government spending in economic growth?

Government spending can stimulate economic growth by increasing aggregate demand, leading to higher production and employment.

How do tax policies affect business investment and consumer spending?

Tax policies can influence business investment and consumer spending by altering the incentives and disposable income available to these groups.

What is the impact of government regulations on innovation and economic efficiency?

Government regulations can both encourage and hinder innovation and economic efficiency, depending on their specific design and implementation.